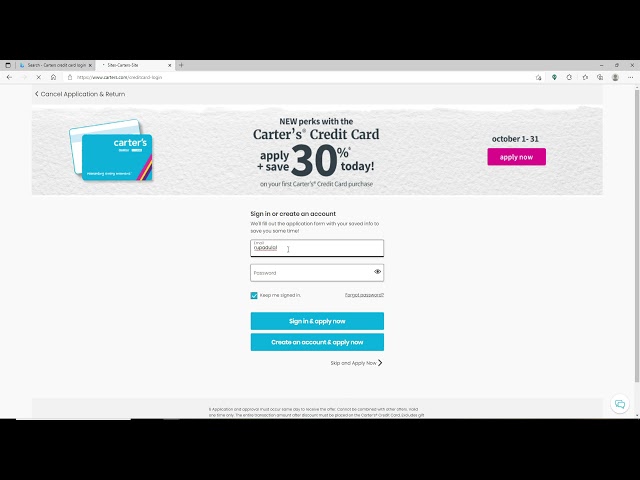

If you’re a fan of Carter’s and want to take advantage of their credit card rewards program, here’s a step-by-step guide on how to apply for a Carter’s credit card

Checkout this video:

Introduction

Carter’s is a major retailer of children’s clothing, offering a wide variety of fashionable and affordable options for kids of all ages. The Carter’s credit card is a great way to save on your purchases, with exclusive cardholder deals and savings opportunities. Applying for the Carter’s Credit Card is easy and can be done online, in-store, or over the phone.

Applying for a Carter’s Credit Card

Applying for a Carter’s credit card is easy and can be done in just a few minutes. To begin the process, simply gather the required information listed below. Then, either fill out an online application or print out and complete a paper application. Finally, mail your completed application to the address provided.

Required Information:

-Your full name

-Date of birth

-Social security number

-Mailing address

-Phone number

-Email address

-Credit history information

The Application Process

Applying for a Carter’s credit card is a simple process. You can either apply online or in person at a Carter’s store. The application process is the same for both methods.

To apply, you will need to provide some personal information, such as your name, address, and date of birth. You will also need to provide your Social Security number and driver’s license number. In some cases, you may also be asked to provide employment information.

Once you have gathered all of the required information, you can begin the application process. The process is straightforward and should only take a few minutes to complete.

The credit card Agreement

Before you can start using your Carter’s Credit Card, you must first agree to the terms and conditions set forth in the credit card agreement. This document outlines important information such as your credit limit, interest rates, and payment terms.

To agree to the credit card agreement, simply follow the instructions on the application page. You will be asked to provide your name, address, date of birth, and social security number. Once you have submitted this information, you will be directed to the agreement page.

There, you will be asked to review the terms and conditions and check a box indicating that you agree to them. Once you have done so, you will be able to start using your Carter’s Credit Card immediately.

Fees and Interest Rates

The Carter’s credit card charges a $29 annual fee. The interest rate is 24.99% APR for purchases and balance transfers. There is no intro APR offer.

Rewards and Benefits

The Carter’s credit card offers many great rewards and benefits to cardholders. Some of the main benefits include 5% off all purchases made at Carter’s stores, as well as access to exclusive sales and events. Cardholders also earn 2 points for every $1 spent at Carter’s stores, which can be redeemed for coupons, discounts, and more.

Carter’s Credit Card Customer Service

Carter’s Credit Card Customer Service is available to help you with any questions or concerns you may have about your credit card account. You can reach them by phone at 1-888-475-4444 or by email at carters@carters.com.

FAQs

Q: How do I apply for a Carter’s credit card?

A: Applying for a Carter’s credit card is easy! You can either apply online or in-store. If you’re applying online, simply fill out the application form and submit it. If you’re applying in-store, ask a sales associate for an application form.

Conclusion

We hope this guide has been helpful in explaining how to apply for a Carter’s credit card. Applying for a credit card can be a difficult process, but it is worth it to have the extra financial flexibility that a credit card can provide. Be sure to carefully consider all of the information we have provided before you decide whether or not to apply for a Carter’s credit card.

Additional Resources

If you’re interested in learning more about credit cards we’ve put together some additional resources that can help.

Our credit card primer gives an overview of the different types of credit cards available, and helps you choose the right card for your needs.

If you’re looking to build or rebuild your credit history, our guide to secured credit cards can help you get started.

And if you’re not sure whether a Carter’s Credit Card is right for you, our comparison of Carter’s Credit Card with other retail store credit cards can help you make a decision.