How often should you apply for a credit card?

You can find out the answer to this question and more by reading this blog post.

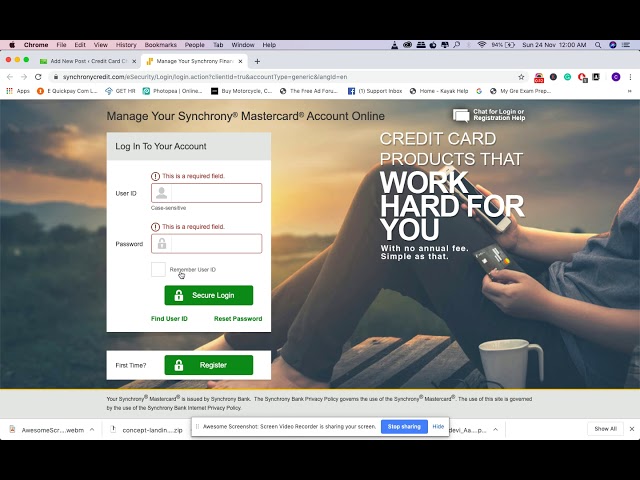

Checkout this video:

Applying for a credit card

Applying for a credit card too often can negatively affect your credit score. If you’re thinking about applying for a new credit card it’s important to know how often you can do so without harming your credit score.

The answer depends on a few factors, including how many credit inquiries you have and how long ago they were. Inquiries stay on your credit report for two years, but they only affect your score for the first year.

In general, you should limit the number of credit applications you submit to no more than one or two per year. This will help you avoid damaging your credit score and costing you money in the long run.

How often should you apply for a credit card

There is no set answer to this question, and it ultimately depends on your individual credit situation. However, experts generally recommend against applying for more than one Credit Card every six months, as this can have a negative impact on your credit score. Additionally, it’s important to be mindful of the different types of credit cards (e.g., rewards cards, cash back cards) and make sure you’re not applied for more than you can handle.

The benefits of applying for a credit card

Applying for a credit card can provide you with a number of benefits. For one, it can help you build your credit history. And, if you use the credit card responsibly, you can improve your credit score. Additionally, having a credit card can give you financial flexibility and peace of mind in case of an emergency.

Of course, there are also some risks associated with applying for a credit card. For example, if you carry a balance on your credit card from month to month, you will likely end up paying interest on that balance. Additionally, if you are not careful about using your credit card, you could end up damaging your credit score.

So, how often should you apply for a credit card? Experts suggest that you should only apply for a new credit card when you need one. For example, if you are planning to make a large purchase and want to take advantage of a 0% APR introductory offer, that would be an ideal time to apply for a newcredit card. Or, if you are trying to rebuild your credit history after bankruptcy or foreclosure, applying for a new credit card can help you do that. However, if you already have several credit cards and don’t think you need another one, there is no benefit to applying for another one.

The best time to apply for a credit card

The best time to apply for a credit card is when you have good credit and you are able to qualify for a lower interest rate. If you have bad credit, you may still be able to get a credit card, but it will likely have a higher interest rate.

How your credit score affects your credit card application

Your credit score is one of the most important factors in determining whether or not you’ll be able to get approved for a credit card.

Generally speaking, the higher your score, the more likely you are to be approved for a card. That’s because lenders see people with high scores as less of a risk — meaning they’re more likely to pay back their debts.

If you have a score of 700 or above, you’re in good shape and should have no problem getting approved for most cards. But if your score is below 700, you may still be able to get approved — it just might take a little more work.

If you’re not sure where your credit score stands, you can check it for free on sites like Credit Karma or Credit Sesame. And if it’s lower than you’d like, there are steps you can take to improve it.

Once you know your credit score, you can start researching which cards might be a good fit for you. Just remember that even if you have a good score, there’s no guarantee you’ll be approved for every card you apply for. Lenders also take into account factors like your income and credit history when they make their decision.

The different types of credit cards

There are four main types of credit cards: rewards cards, cash back cards, balance transfer cards, and 0% intro APR cards. Each type of card offers different benefits, so it’s important to choose the right card for your financial needs.

Rewards cards offer points, miles, or cash back on every purchase you make. If you spend a lot of money on your credit card, a rewards card can be a great way to earn back some of that money. Cash back cards give you a percentage of your purchases back in the form of cash or points. Balance transfer cards allow you to transfer the balance of another credit card to your new card with a 0% intro APR for a certain period of time. 0% intro APR cards offer 0% interest on purchases or balance transfers for a promotional period of time.

The type of credit card you should apply for depends on your financial needs and spending habits. If you are looking to save money on interest, a balance transfer card may be the best option for you. If you want to earn rewards on your purchases, a rewards or cash back card may be the better choice. And if you are looking for a 0% intro APR period on your purchases or balance transfers, a 0% intro APR card is the way to go.

How to choose the right credit card

When it comes to money matters, there are a lot of myths and misunderstandings out there. When it comes to credit cards, one of the most common myths is that you should only ever apply for one credit card. This simply isn’t true. In fact, applying for multiple credit cards can actually be beneficial to your financial health – but only if you do it the right way.

One of the main benefits of having multiple credit cards is that it can help you build up your credit history and improve your credit score. This is because each time you make an on-time payment, it gets recorded on your credit report. And the more positive marks you have on your report, the higher your score will be.

Aside from building up your credit score, having multiple credit cards can also come in handy in other situations. For example, let’s say you have two cards – one with a $500 limit and another with a $1,000 limit. If you need to make a large purchase that exceeds your $500 limit, you can put it on your card with the higher limit and then pay it off over time. This can be helpful if you need to make an emergency purchase or if you’re planning a big vacation and need to pay for hotels or airfare upfront.

Of course, there are also some drawbacks to having multiple credit cards. For one thing, it can be tempting to spend more money than you have if you know you have access to multiple lines of credit. And if you carry a balance on more than one card, you could end up paying more in interest fees than if you just had one card.

It’s also important to note that applying for multiple credit cards in a short period of time can actually hurt your credit score. This is because each time you apply for a new card, the lender will do a “hard pull” on your report – which will temporarily lower your score by a few points. So if you’re planning on applying for more than one card within a few months, it’s best to space out your applications so as not to ding your score too much.

All in all, there’s no right or wrong answer when it comes to how many credit cards you should have. The important thing is to use them responsibly and only apply for new cards when necessary.”

Applying for a credit card with bad credit

If you have bad credit, you might be wondering how often you should apply for a credit card. The answer depends on a few factors, including your credit score and your financial goals.

If you have bad credit, it’s important to remember that every time you apply for a new credit card, your credit score will take a small hit. This is because each time you apply for a new credit card, the lender will do a hard inquiry on your credit report. Hard inquiries can stay on your report for up to two years and can ding your score by a few points.

So, if you’re trying to rebuild your credit, you might want to space out your applications for new credit cards. This way, you can avoid too many hard inquiries on your report and give yourself time to improve your credit score before applying for new cards.

Typically, experts recommend waiting at least six months in between applications for new credit cards. However, if you have bad credit, you might want to wait even longer between applications to give yourself the best chance of getting approved and getting a card with favorable terms.

The consequences of not paying your credit card bill

If you don’t pay your credit card bill, you will be charged interest on the outstanding balance. The interest rate will be determined by your credit card company, and will be higher than the rate you would pay if you paid your bill on time. You may also be charged a late fee if you don’t pay your bill by the due date. If you continue to miss payments, your account may be turned over to a collection agency. This can damage your credit score and make it difficult to get approved for new credit.

How to use your credit card wisely

Credit cards offer many benefits, such as the ability to earn rewards, build credit and improve your financial flexibility. However, misuse of credit cards can lead to debt and high interest rates. When used wisely, credit cards can be a valuable tool. Here are some tips on how to use your credit card wisely:

1. Use your credit card for planned purchases: It’s best to use your credit card for planned purchases that you can afford to pay off in full each month. This will help you avoid interest charges and keep your debt-to-credit ratio low, which is good for your credit score.

2. Set up a budget: Before you use your credit card, it’s important to set up a budget so you know how much you can afford to spend. Once you have a budget in place, stick to it!

3. Pay your bill on time: It’s important to pay your credit card bill on time each month. This will help you avoid late fees and keep your interest rates low.

4. Monitor your spending: Keep tabs on how much you’re spending each month so you don’t get into debt. A good way to do this is by tracking your expenses using a budget or personal finance app.

5. Only use what you need: Credit cards offer many different features, such as cash back rewards and travel perks. However, these features come with a cost – usually an annual fee. If you don’t think you’ll use the features of a particular credit card, it may be best to avoid it altogether.